The success of your business depends on managing your finances, understanding accounting, and interpreting your company’s numbers.

Accounting and finance involve tracking and analyzing business activities. When these two aspects are in balance, your financial operations work at their best.

Knowing how money comes in and goes out helps you make smarter decisions to prevent business setbacks. This article provides insights into the key differences between accounting and finance.

Finance

The finance field involves overseeing money and investments for people, companies, and governments. Finance professionals have jobs in areas like investment banking, wealth management, and financial planning and analysis. Whether they’re helping individuals or businesses, their main task is to make sure there’s enough money (capital) for the situation and to use the funds wisely. Their goal is to add value by managing money in a way that generates better-than-expected returns while considering the associated risks.

Importance and Role of Finance in Business

Finance is crucial for businesses as it helps them reach their financial goals. It involves various activities to manage and maximize available resources. Cash flow management plays a key role in ensuring there’s enough money for daily expenses. Finance also guides investment decisions, helping companies choose assets that generate returns.

Additionally, it plays a vital role in risk management by analyzing market trends and suggesting ways to minimize risks while maintaining revenue. Proper financial management, whether internally or through external consultants, is essential for businesses to thrive amid competition and economic uncertainty.

Accounting

Accounting involves keeping track of a company’s money matters, recording financial activities, and creating reports. Accountants can work independently, within companies, or at public accounting firms. Their job is to make sure all financial transactions are accurately recorded, account balances are right, and financial statements are precise.

Importance and Role of Accounting in Business

Accounting plays a crucial role in businesses and is often called the “Language of Business.”

It involves recording, summarizing, analyzing, and keeping track of financial transactions, which helps owners, managers, and investors assess the financial well-being of a company. This information is vital for making informed and strategic business decisions.

Accounting is necessary to monitor a business’s activities, including allocating costs to goods or services, creating budgets, and preparing financial reports. These reports can be customized to guide specific financial strategies for different sectors of your business.

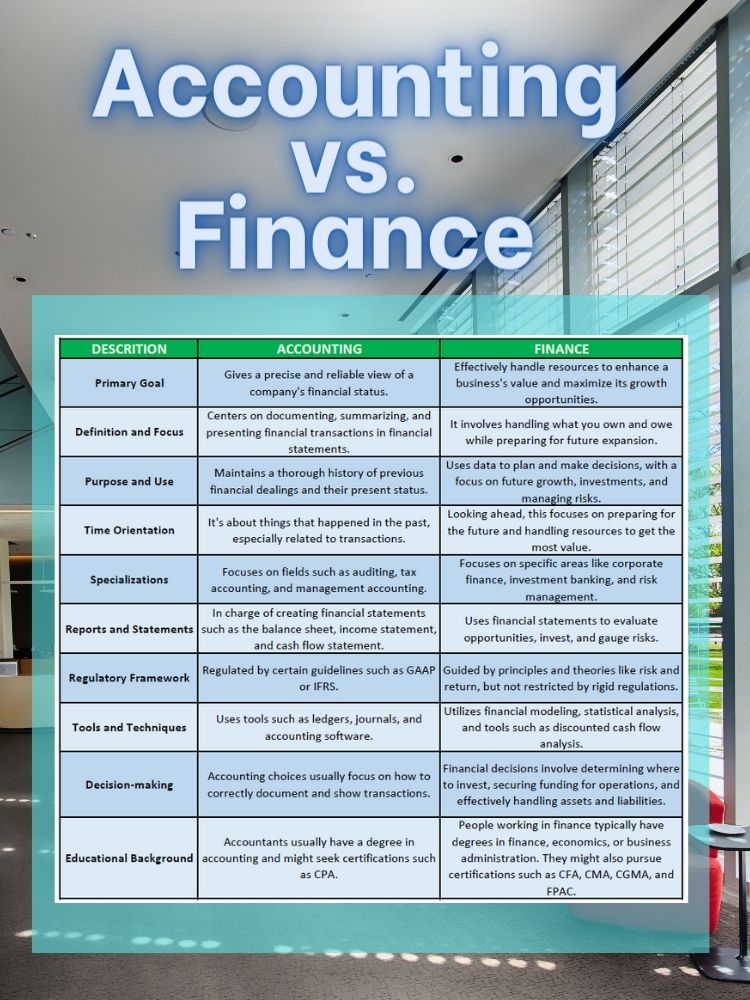

Finance vs. Accounting Overview

Why Do Businesses Use Accounting and Finance?

Managing your business’s accounting and finances is crucial. Without a clear understanding of your money flow, you risk losing control of your business. Properly handling income and expenses not only fosters growth but also provides access to strategies that can help your company endure unexpected financial challenges. Let’s explore how accounting and finances influence your business management.

Records Keeping

Maintaining financial records is like keeping a diary of a company’s money matters. The ledger, where accountants and small business owners jot down income and expenses, is crucial for tracking daily operations. An accurate financial record helps businesses plan for the future and comprehend their cash flow.

Steer Clear of Legal Issues

Accurate financial records are essential to abide by business laws. Missing even a small detail can have big consequences for tax management. Financial managers need to know which expenses to deduct, how much tax to pay, and when to pay it. Poor record-keeping may lead to audits and legal problems. Neglecting financial details related to facility improvements could also result in violating safety regulations.

Budgeting Basics

Using financial records and understanding cash flow helps in creating a budget, a tool that keeps your business on the right path. A budget provides a current view of your financial status and guides your business toward growth. When crafting a budget, consider net income, expenses, goals, and unexpected adjustments. Staying on top of these numbers is crucial for business management and success.

Performance Analysis

Successful business owners regularly assess their company’s performance. Examining historical and current records of assets, liabilities, and other financial aspects helps gauge the company’s well-being. Learn from past mistakes and make informed decisions for a more prosperous future. Knowing your current financial standing identifies areas for growth and supports your bottom line.

Strategic Development

Sound accounting and finance management lead to a good strategy. With a budget and thorough data analysis, it becomes easier to develop a strategy to achieve your goals. Reviewing financial records empowers you to make informed decisions, from staffing to supply management. Your budget acts as a map for your strategy, which is your key to profitability.

External Communication

Clear accounting and finance management are crucial when dealing with external parties. Well-maintained financial records are valuable when seeking a loan or attracting potential investors. Good financial management facilitates the provision of financial statements to external stakeholders. These reports guide external users in deciding their involvement with your business.

Internal Communication

Financial reporting aids in communicating information to internal stakeholders. Employees interested in profit-sharing and stock-based compensation find this information relevant. Financial records enable owners to communicate their business’s strengths and weaknesses to their teams. Sharing your financial standing can be tied to a bonus structure, serving as a productivity incentive.

Role with Financial Statements

Finance and accounting professionals have distinct roles when it comes to financial statements. Accountants mainly create the statements, while finance professionals primarily analyze them.

Corporate Functions

Here are the main corporate functions in finance and accounting:

Finance

- Funding the business

- Raising capital (debt and equity)

- Optimizing the firm’s Weighted Average Cost of Capital

- Seeking the best risk-adjusted returns

- Corporate strategy

- Budgeting and forecasting

- Mergers and acquisitions

Accounting

- Bookkeeping

- Tracking of revenues and expenses

- Internal reporting

- Financial reporting

- Auditing

- Risk management

Clientele Differences

Both accounting and finance experts serve individuals, businesses (corporations), governments, and non-profit organizations as clients. However, there are notable distinctions in their employment preferences. The primary opportunities for each group are outlined below.

Finance

- Banks (retail, commercial, and investment)

- Insurance companies

- Research companies

- Operating companies (regular businesses)

Accounting

- Public accounting firms (conducting audits for large companies)

- Firms specializing in personal tax filing

- Operating companies (businesses)

Distinguishing Traits

Accounting and finance careers attract different types of personalities. Here are key traits for each:

Finance

- Analytical

- Inquisitive

- Pays high attention to detail

- Thinks about scenarios

- Focused on adding value

- Possesses business development skills

- Strong problem-solving abilities

Accounting

- Accountable

- Detail-oriented

- Uses rules-based thinking

- Emphasizes risk management

- Procedure-oriented

- Prioritizes accuracy

Conclusion

Accountants use past financial data to create reports, focusing on historical information. In contrast, finance professionals try to foresee the future, facing the challenging task of predicting upcoming financial trends. In both accounting and finance, accuracy and skill are crucial. If you’re in accounting, your record-keeping aids the finance team, while those in finance rely on the precise work of accountants. Both fields offer rewarding work with competitive compensation, requiring a strong education and proficiency in quantitative analysis.