A couple of key data indicators show that the record rampant inflation of 2021 and 2022 has peaked. This is welcoming news for the central banks, politicians, and of course businesses and households.

All four of the most important factors, which economists place as key inflation indicators, have all begun to subside: Shipping rates, commodity prices, factory gate prices, and overall inflation expectations are all looking positive as we head into 2023.

These figures suggest that the global supply chain, which has been continuously strained for almost three years for a number of different geopolitical reasons, is finally easing up. Let’s take a look at some key metrics from around the world:

United States

In September, the stock market jumped significantly thanks to August’s better than expected inflation report. Many people celebrated this news as the beginning of the end of inflation, but the problem was that the numbers were quite small and perhaps overhyped.

Both the headline inflation rates and core (food, energy, etc.) inflation rates reported monthly increases that were only 0.2 percentage points lower than expected, while headline consumer price index stayed the same. Overall, the Year-on-Year inflation rate stayed the same at 5.9%.

In October and November, the evidence pointed to more hopeful statistics that show that inflation has peaked in the US. Energy prices (in the US alone) have gone down or stayed even, while shipping costs and delivery times have eased up significantly. And while there is much controversy about the Fed’s interest rate policies, it has successfully slowed the housing market which is a significant inflation reducer.

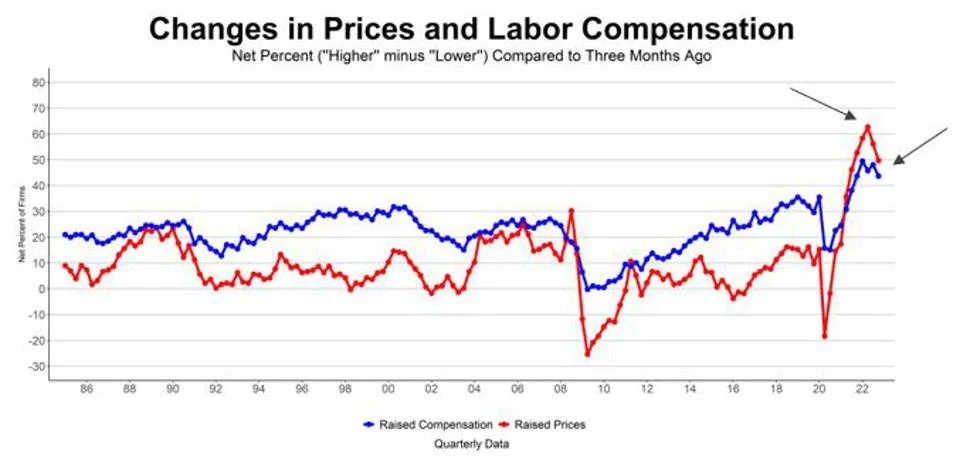

However, not all is fine in the US economy. One of the biggest inflation factors that keeps feeding the inflation cycle is labor compensation (raising employees salaries means that the company has to charge more for their product to cover the cost, meaning other people need more money to pay for it, which continues the cycle of rising inflation).

The U.S. job market is currently as tight as it has ever been with nearly two job openings per unemployed person. Despite all of the talks of layoffs and recessions, employees are still in control in asking for higher salaries. Many economists believe that inflation will not fully subside until there will be a recession or a large reduction in the number of job openings.

In addition, there is a psychological aspect that is different from past periods of inflation and recession. While in a normal economic downturn travel, entertainment, and restaurants are the first things that people stop spending on, due to the pandemic restrictions, consumers are far more likely to spend money on vacations and entertainment which means there won’t be a natural reduction in that either.

Overall, the Fed should be happy that a recession might be avoided, however without a recession, inflation might not come down to the 2% mark that they set as a goal.

European Union

While the European Union’s economy might be similar to the US in closely following their interest rate hikes, the EU’s inflation is far more uncertain thanks to one factor: energy.

The war in Ukraine has significantly damaged Europe’s fight to reduce inflation, as energy is needed for just about everything to make the economy run. Unlike the US who has plenty of domestic natural resources, the EU almost completely relies on foreign energy, including from Russia.

Inflation in the 19 countries that use the Euro hit a record 10.6% in October, and it is not expected to fall much at all in the following months. In fact, Christine Lagarde, the President of the Eurozone warned that inflation has not peaked and risks rising even higher than predicted.

“We do not see the components or the direction that would lead me to believe that we’ve reached peak inflation and that it’s going to decline in short order,” Lagarde told the European Parliament.

In addition, she hinted at possible interest rate hikes in the future in order to help curb inflation.

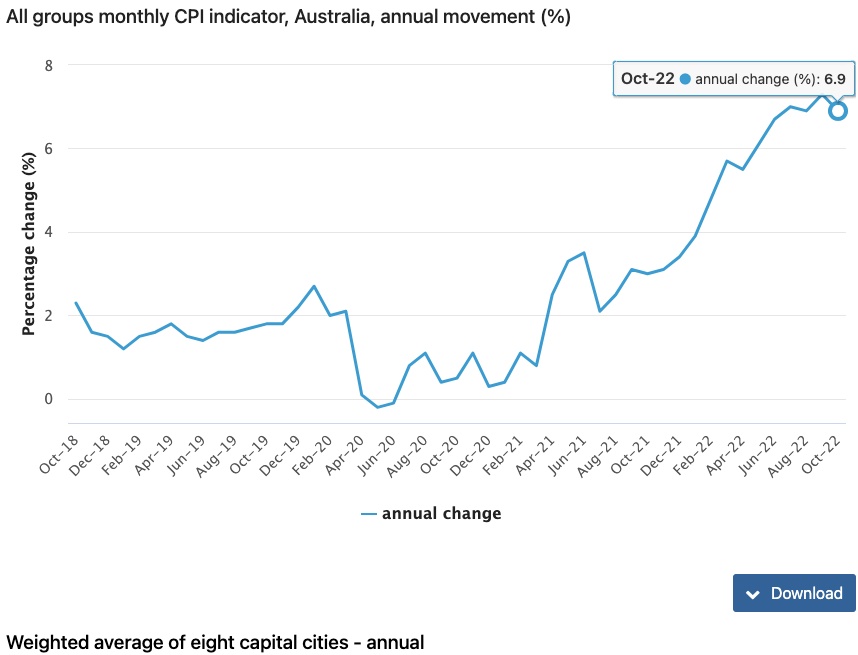

Australia

In Australia, the inflation rate eased in October, as the headline CPI came in at 6.9% in comparison to 7.3% in September. This was largely due to food prices rising less than expected. Annual growth also slowed to 5.3% in October (from 5.4%) even though it was expected to increase to 5.7%.

While these are key indicators that inflation has peaked, Australia has a similar problem to Europe in terms of energy prices and also is susceptible to more volatile food prices and shipping costs due to its location.

However, the question now is whether the Reserve Bank of Australia will continue to raise interest rates with the new, hopeful inflation data. Many expect the Reserve Bank to raise interest rates by another 25 basis points in December.

Preparing for 2023

With the mixed messages coming from different metrics, economic areas, and monetary policies, it is hard to pinpoint the exact direction that global inflation is heading.

For the US, the most important indicator to look out for is job openings. As long as there are a large number of job openings in comparison to employees, it will be very difficult to reduce inflation as labor compensation will continue to push inflation higher. However, inflation seems like it is heading in the right direction, even if it will take longer than expected.

For the EU and Australia, the main question is energy prices. With the geopolitical uncertainty with Russia, it will be very difficult to bring down inflation as energy is such an important factor that is out of these countries’ control.

For finance experts, the most important thing is to be prepared. Global inflation, supply chain issues, and energy prices directly affect almost every aspect of business. Using tools such as budgeting and forecasting software is the best way to analyze situations and be prepared for the effects of increasing or decreasing inflation.

Another important question is China’s long term Covid-19 policies. If they continue to follow strict measures, it may disrupt the supply chain and continue to complicate things.

Lastly, is how the central banks respond to all of these scenarios. If they continue to raise interest rates in order to speed up inflation reduction, it will have significant consequences for the economy. On the other hand, it might be necessary in order to beat inflation once and for all.