The income statement, also referred to as the profit and loss (P&L) statement, provides a snapshot of an organization’s revenues, expenses, and net income during a specific time frame. It is a crucial financial document closely analyzed by all organizations. Despite its apparent simplicity, the data it contains holds valuable insights.

It serves as a comprehensive summary of all income and expenses within a specific timeframe, encompassing the combined effects of revenue, gains, expenses, and losses. These statements are typically presented on a quarterly and annual basis, offering insights into financial trends and comparisons over time. Interpreting this statement is vital to evaluate a firm’s past financial performance and predict its future prospects. Therefore, users must grasp the narrative conveyed by each income statement to make informed decisions.

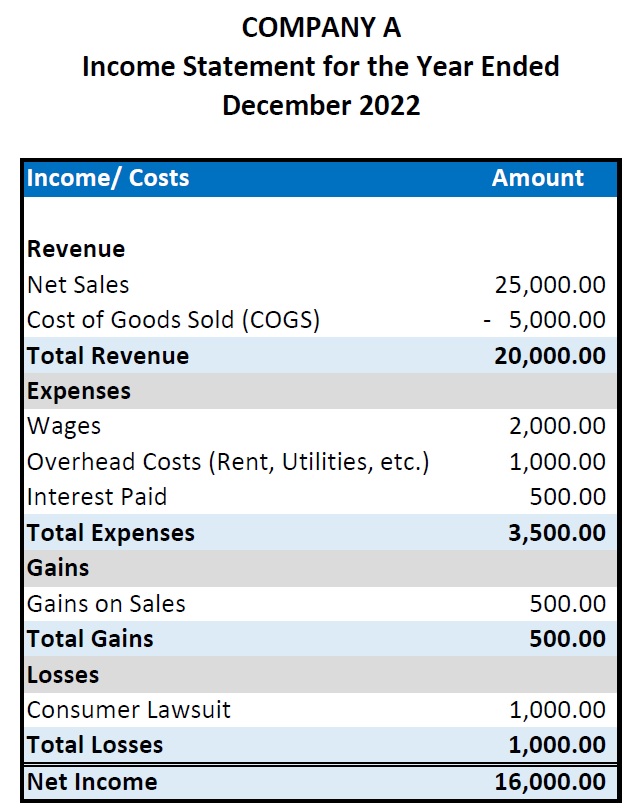

Income Statement: What Does it Look like?

Although income statements vary in their appearance, they share a core set of data: total revenue, total expenses, and net income. These elements are essential, but additional information is often provided in each section to offer deeper insights into the organization’s financial activities. Common line items and their typical order include:

- Product-level Revenue

This figure represents the income generated from specific products sold by the company. If the organization sells multiple products, there may be several lines detailing revenue for each.

- Cost of Goods Sold (COGS)

This item outlines the direct costs associated with the product, such as raw materials. For instance, a paper mill would include the cost of pulp used for paper manufacturing in the COGS section.

- Gross Profit

This is the revenue remaining after deducting COGS. Essentially, it represents the funds available to cover operational expenses and compensate stakeholders.

- Selling, general, and administrative expense (SG&A)

This category encompasses all costs linked to product sales and general organizational operations.

- Interest Expense

This line item shows the interest payments made by the firm to finance its operations during the specified period.

Here’s an example of what an income statement looks like:

The Use and Importance of Income Statement

Income statements, when analyzed alongside the cash flow statement, balance sheet, and annual report, provide crucial insights for company leaders, analysts, and investors. These statements offer a comprehensive view of a business’s operational performance, aiding in the assessment of its value, efficiency, and potential future trajectory.

By scrutinizing an income statement, one can identify trends such as declining costs of goods sold or improving sales, as well as rising return on equity. Businesses often meticulously examine income statements when aiming to reduce expenses or devise growth strategies.

Mastering the skill of interpreting income statements empowers individuals to make well-informed decisions about a company, be it their own, their employer, or a potential investment opportunity.

Companies can divide their financial categories into smaller parts based on their rules and how detailed their financial statements are. For instance, they might break down revenue by product or division and expenses into things like procurement, wages, rent, and interest on loans.

Various other analyses can be conducted as part of a comparative company analysis using the income statement. The key takeaway is that any analysis of an income statement should involve a comparative approach to provide the necessary context for the reported numbers and associated metrics. This approach enables investors, management, and other stakeholders to fully grasp the financial performance of an organization and make well-informed decisions.

Conclusion

The income statement, or profit and loss (P&L) statement, is a fundamental financial document that offers a comprehensive overview of an organization’s financial health. While seemingly straightforward, it contains vital information that holds valuable insights into a company’s revenue, expenses, and net income over a specific period.

Understanding the narrative conveyed by each income statement is essential for evaluating past financial performance and predicting future prospects. By automating P&L statements and delving into key metrics such as revenue growth, gross profit margin, and net profit margin, investors can make informed decisions, especially when comparing companies within the same industry.

These insights not only aid investors but also empower management and stakeholders to make strategic, well-informed choices, ensuring the financial stability and success of the organization.